Backed by AtlasInvest – a leading private equity firm in the energy sector – Aukera Energy is a key player in the global renewable energy landscape. The company has an international presence with teams across Europe, in the UK, Italy, Romania, Germany, and Belgium. Despite having no dedicated internal ESG resource, with responsibility for ESG taken on by the CFO and founders, Aukera holds itself to the highest ESG standards and is dedicated to driving long-term stakeholder value.

The team decided to make a proactive change to better monitor their metrics, and KEY ESG’s software has not only met Aukera's investors' immediate compliance needs, but it has also empowered them to tailor their ESG metrics around specific business objectives and challenges. KEY ESG's scalable software and hands-on guidance enabled Aukera to produce their first ESG report within a month. From there, their ESG endeavours have gone from strength to strength.

Read more about Aukera’s progress in our Case Study.

Fill in the form below

Thoughts from our ESG experts

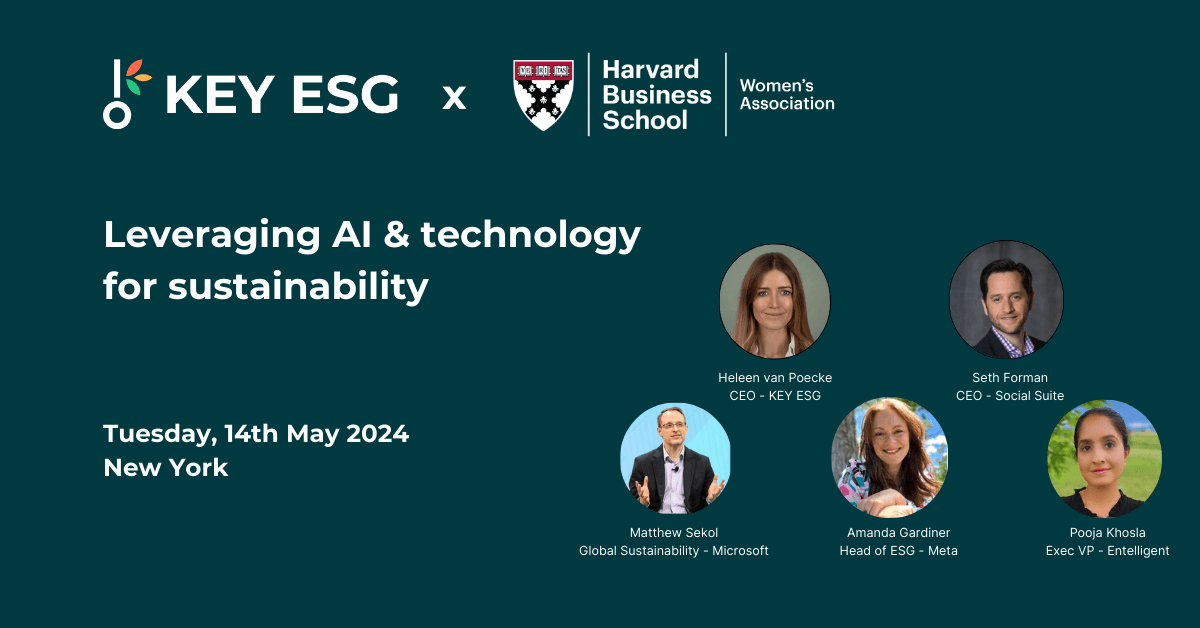

Harvard Business School ESG series event: leveraging AI & technology for sustainability

Read more.png)

A.P. Moller Capital uses KEY ESG software to enhance its ESG reporting and empower portfolio companies to take ownership of their ESG strategies

Read more

%20(8)%20(1).png)