The Conference of the Parties, more commonly known as COP, is the United Nation’s climate change conference. As COP27 begins, businesses and investors are looking to world leaders to set the course for the next instalment of climate-orientated initiatives. Today, we're taking a closer look at what COP27 is, why it's important, and how the event will affect fund managers.

When and where is COP27?

COP27 is currently taking place in Sharm El-Sheikh, Egypt, and will end on 18th November.

Governments and leaders from all around the world have gathered to discuss strategies to combat climate change and protect the environment. The decisions made as a result of COP27 will affect businesses in many ways in the years to come. This impact will subsequently affect investing and private equity.

Why is COP important?

Sustainability and climate change are topics at the forefront of many discussions at a government level. However, although many leaders have set ambitious targets, little progress has been made since COP26.

COP27 will not only establish a new climate agenda, it will also follow up on the aims and goals established at COP26. One of these agendas was the Glasgow Financial Alliance for Net Zero (GFANZ). The GFANZ saw 160 firms across the financial industry - such as banks, insurers, asset managers, and pension funds - commit to reaching net zero by 2050. This decision was aligned with the goals of the Paris Agreement.

This year’s conference will assess the progress made towards goals such as the GFANZ. It will also look at topics such as greenhouse gas emissions (GHG), deforestation, fossil fuel consumption, the energy crisis, and more. The focus, however, should be on the actions taken, rather than the targets set.

How will COP27 impact businesses?

Since COP26, environmental, social, and governance (ESG) metrics have become increasingly important for businesses and investors.

Disclosure requirements are becoming more and more demanding, bringing sustainability issues to the attention of asset managers. This has meant that companies and investors have been held more accountable, as these disclosures have, in many cases, been open to public scrutiny.

Many of our previous blogs have examined issues with the lack of clarity and uniformity in ESG legislation. In many cases, ESG rulings have been left open to interpretation. COP27 is expected to address some of these issues.

Will COP27 affect investors?

More investors than ever before are making investment decisions with ESG in mind. This has a positive collective effect, as it offers a financial incentive for carbon-reduction and sustainability more generally, aligning sustainability principles with global targets.

COP27 is expected to further incentivise this ESG-orientated shift in investment decision-making. As responsible investing becomes more and more prevalent, businesses lagging behind in their ESG measurement will be encouraged to optimise their processes to secure investment.

Investors are becoming more aware of the fact that sustainability should not be an afterthought in the investment process. ESG should instead be seen as a core tool to help future-proof investments, as disclosure requirements become ever more strict.

What investors should expect

The European Bank for Reconstruction and Development (EBRD) has warned that COP27 could cause issues if the event focuses on targets rather than action. Harry Boyd-Carpenter is the managing director of climate strategy at the EBRD. He posits that investors could fall victim to a "ratchet effect". This would occur if more and more pledges were made, and climate action fell short of these expectations.

ESG measurement is ineffective if investors and portfolio managers don't take action based on the insights gathered. Similarly, private sector organisations should focus more on delivering previous pledges than on setting new ones.

How COP27 will affect ESG strategies

As environmental concerns are once again brought to news headlines, and as leaders report on the progress made since COP26, we can assume that the 'E' in ESG will become a main topic of concern.

The first step in optimising ESG strategies is to ensure they are being measured correctly. Accurate ESG measurement techniques allow general partners and limited partners to identify issues and develop a plan of action to tackle these problems. Regular reporting also allows fund managers to track ESG progress and ensure they are on track to reach targets.

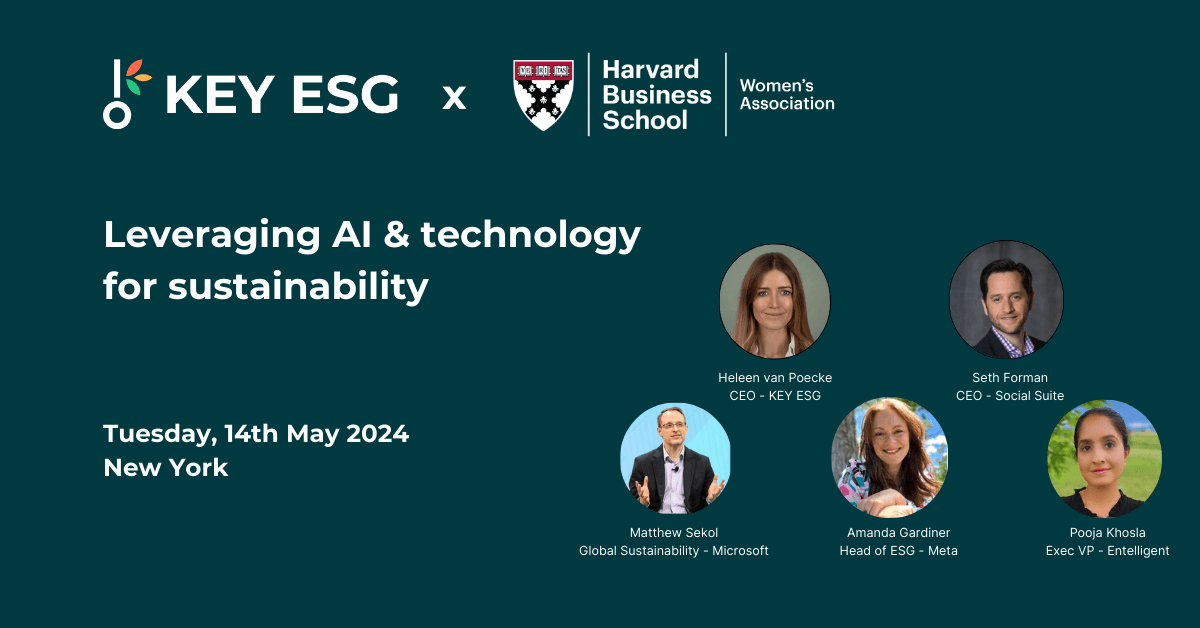

KEY ESG's software facilitates this. As COP27 sets the agenda for the next phase of sustainability efforts, our experts are preparing to incorporate new guidance into our intuitive interface.

If you have any questions about ESG management, or you'd like a free demo, feel free to get in touch with a member of our team!

.png)

.png)