Unlocking sustainable advantage with Anne-Marie Schoonbeek and Heleen van Poecke

by Becca Carnahan

Anne-Marie Schoonbeek (MBA 2017) and Heleen van Poecke (MBA 2017), grew up in small towns in The Netherlands fifteen minutes apart from one another. Yet, in all those years, their paths never crossed.

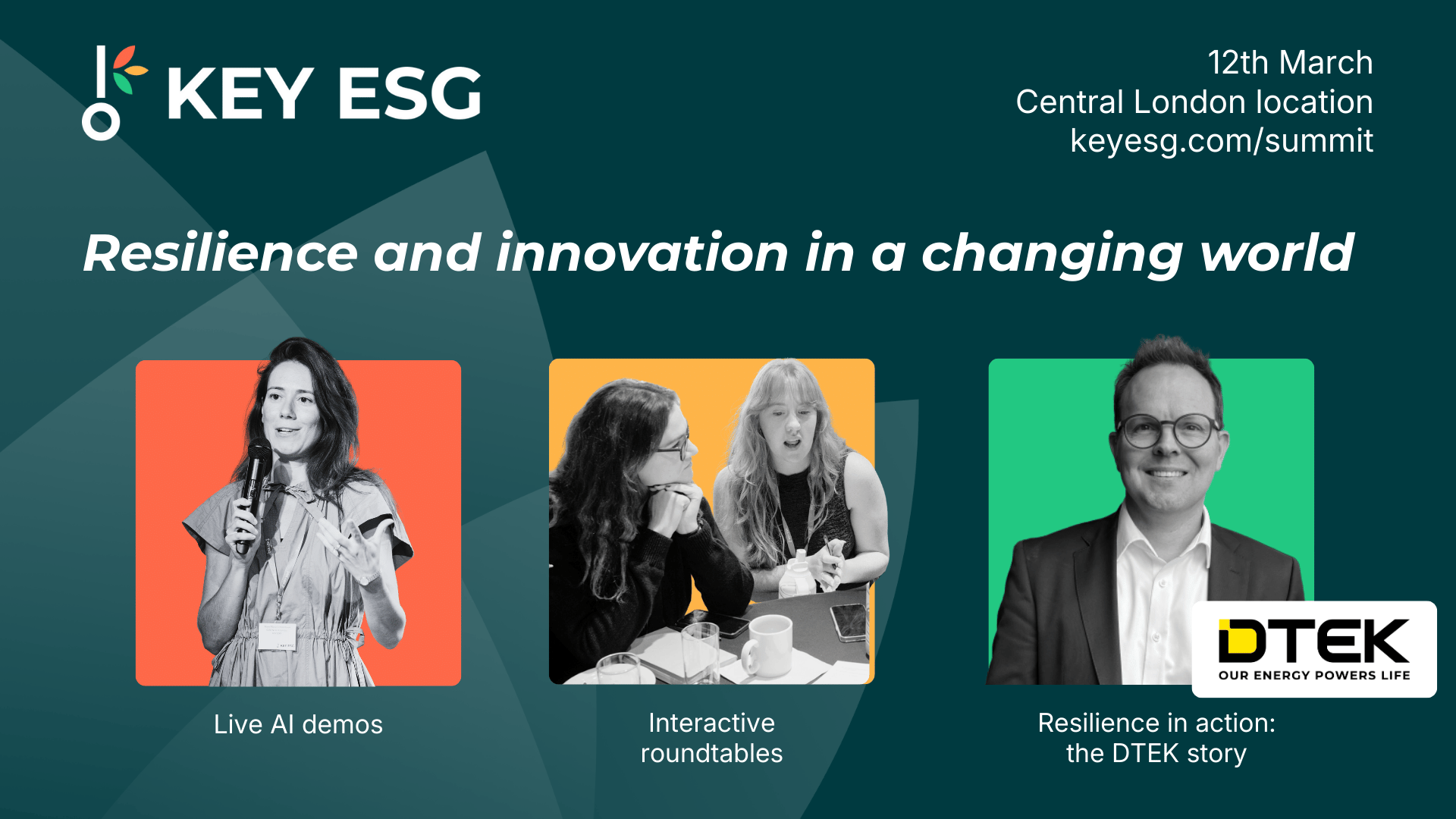

Instead, over 3,000 miles away from home, Harvard Business School brought the two co-founders together. Building on the friendship they formed at HBS during their MBAs, and the learnings from their careers to date, Schoonbeek and van Poecke founded KEY ESG - a software solution that helps businesses measure, manage, and report Environmental, Social, and Governance (ESG) performance.

The path to KEY ESG

Prior to joining HBS, Schoonbeek worked at McKinsey for two years analyzing a range of business problems in different industries. “HBS was a very logical extension to that experience because, after a few years at McKinsey, you have an understanding of what is working in the real world and then HBS elevates that perspective to the next level,” she shared.

Schoonbeek was also eager to gain more experience as an operator at a startup company, supplementing her experience as a consultant working with large businesses. Specifically, she was drawn to healthcare. This led her to Omada Health for her internship and then later back to McKinsey after graduation, where she focused on both large-cap and startups in the pharmaceuticals and biotech space. “For me, this was a way of making an impact,” said Schoonbeek.

van Poecke began her career on another path, starting in investment banking before transitioning into private equity. She enjoyed her work as an investor but wanted to broaden her skillset and explore a more operational career path.

She decided to apply to Harvard Business School for two main reasons.

“The U.S. is such a powerhouse when it comes to building fantastic companies, and I felt like an MBA in the U.S. would teach me valuable skills,” she said. “HBS really stood out to me in particular because it has a very strong alumni network, even in Europe."

Her first role outside of finance was a summer internship in operations at Uber, and she then joined Collibra - a fast-growing Series C start-up based in New York, providing data intelligence software for large enterprises. She later returned to Europe to join her family investment firm, Atlas Invest, which invested in energy companies.

Product-market-founder fit

During their time at HBS, Schoonbeek and van Poecke often discussed their shared objectives of pursuing entrepreneurship at some point in the future. Three years after graduation, they felt that they had identified an opportunity worth pursuing.

“After three years of being a general manager at McKinsey post-HBS, I felt it was time to become an operator,” said Schoonbeek. “I gave myself a few months after leaving McKinsey to ideate on the topics that aligned with my passions and the business problems I could address based on my background.”

Meanwhile, van Poecke was closely collaborating with her portfolio companies on multiple operational initiatives and noticed trends emerging. “Most companies I worked with received an increasing amount of inbound questions for greater disclosure on their ESG performance from their lenders, shareholders and regulators, but were often ill-equipped to provide adequate data and measurement to their stakeholders,” she said.

“It also became very clear that measuring ESG performance was no longer a ‘nice-to-have’ but was mission-critical, impacting company cost of capital, share-price, reputation and the firm’s ability to attract and retain talent, amongst other things. We also observed a mind-set shift away from seeing ESG as a ‘cost-out’ to seeing it as a value creation lever. One that most businesses need to learn how to manage just as effectively as, and in alignment with, their financial performance”.

van Poecke and Schoonbeek started researching the evolution of the broader ESG market and believed there was an opportunity for them to build a business where they could:

- Help their customers unlock value while improving their impact on society.

- Put their Finance, Consulting and SaaS experience to good use.

Conversations with HBS alumni at large, mid-sized, and small companies provided the clarity they needed. Many companies did not know where to start managing ESG performance, and a knowledge gap with regards to ESG was common among senior leaders. This meant ESG was not being managed like other business goals. “Many leaders were starting to see that they needed to provide greater disclosure on how their companies were performing with regards to these issues (sustainability, lack of diversity, inequality), but they did not know how to start measuring and managing it in order to address some of the issues we see in society,” said van Poecke.

What gets measured gets managed

Having identified a clear customer need and a market opportunity, Schoonbeek and van Poecke set about building a scalable, cost-effective, and automated software solution to enable companies to manage and improve their ESG performance.

“There is no uniform set of standards for ESG, which makes it challenging for companies to effectively set ESG targets and manage improvements in the same way as you would with financial performance,” said van Poecke. Schoonbeek and van Poecke pulled from their professional and academic experience to build a software offering that enables companies to not only collect the necessary data to start measuring and managing performance, but also translates it into ESG metrics relevant to their industry. “The metrics we use are based on the latest academic research (including research from HBS professors Rebecca Henderson and George Serafeim) and on guidelines and frameworks (SASB , PRI) most commonly used in the investment industry,” said van Poecke.

In providing tools for data collection, metric calculation and the creation of ESG performance dashboards, KEY ESG allows business leaders to:

- Identify how they stack up against peers in their industry and how they are tracking against their ESG targets over time.

- Build reports for their various stakeholders (employees, shareholders, lenders, regulators) to enable them to communicate effectively and objectively on their ESG progress.

- Gain access to a manager’s toolkit that provides resources and guidance on ESG policy creation, implementation and management.

“We have decided to start building a product for which there is an urgent need amongst our target customer base as well as a willingness to pay,” said van Poecke. “Needless to say, our medium-term product vision is larger, as we think the market and customer needs will continue to evolve”.

Continuous learning is key

van Poecke had spent some time at a software business before co-founding KEY ESG, but there remains a learning curve for both co-founders as they grow their business. A learning curve they welcome.

“You can learn new things if you are open to continuous learning,” said Schoonbeek. “We’ve also been grateful for advisors and experts in our network who have helped us think through choices and have provided us with valuable feedback. We have approached this with a mindset of not being afraid to try and make mistakes. Having all those ingredients will get you going.”

“The field of ESG is evolving rapidly and becoming increasingly relevant,” van Poecke added. “ESG investing and sustainable financing are becoming mainstream, and this will create challenges and opportunities for KEY ESG. We need to continue to learn together with the rest of the market to ensure we offer our customers solutions that help them manage their sustainable advantage. It’s incredibly interesting and exciting and we are learning every day.”

Lastly, key to Schoonbeek and van Poecke’s success as partners has been the friendship that they formed at HBS. “There are definite benefits to starting a company with someone you know very well, career-wise and personally,” shared van Poecke. “It’s clear to us what our strengths are, and they’re very complimentary.”

Unlocking sustainable advantage with Anne-Marie Schoonbeek and Heleen van Poecke

by Becca Carnahan

Anne-Marie Schoonbeek (MBA 2017) and Heleen van Poecke (MBA 2017), grew up in small towns in The Netherlands fifteen minutes apart from one another. Yet, in all those years, their paths never crossed.

Instead, over 3,000 miles away from home, Harvard Business School brought the two co-founders together. Building on the friendship they formed at HBS during their MBAs, and the learnings from their careers to date, Schoonbeek and van Poecke founded KEY ESG - a software solution that helps businesses measure, manage, and report Environmental, Social, and Governance (ESG) performance.

The path to KEY ESG

Prior to joining HBS, Schoonbeek worked at McKinsey for two years analyzing a range of business problems in different industries. “HBS was a very logical extension to that experience because, after a few years at McKinsey, you have an understanding of what is working in the real world and then HBS elevates that perspective to the next level,” she shared.

Schoonbeek was also eager to gain more experience as an operator at a startup company, supplementing her experience as a consultant working with large businesses. Specifically, she was drawn to healthcare. This led her to Omada Health for her internship and then later back to McKinsey after graduation, where she focused on both large-cap and startups in the pharmaceuticals and biotech space. “For me, this was a way of making an impact,” said Schoonbeek.

van Poecke began her career on another path, starting in investment banking before transitioning into private equity. She enjoyed her work as an investor but wanted to broaden her skillset and explore a more operational career path.

She decided to apply to Harvard Business School for two main reasons.

“The U.S. is such a powerhouse when it comes to building fantastic companies, and I felt like an MBA in the U.S. would teach me valuable skills,” she said. “HBS really stood out to me in particular because it has a very strong alumni network, even in Europe."

Her first role outside of finance was a summer internship in operations at Uber, and she then joined Collibra - a fast-growing Series C start-up based in New York, providing data intelligence software for large enterprises. She later returned to Europe to join her family investment firm, Atlas Invest, which invested in energy companies.

Product-market-founder fit

During their time at HBS, Schoonbeek and van Poecke often discussed their shared objectives of pursuing entrepreneurship at some point in the future. Three years after graduation, they felt that they had identified an opportunity worth pursuing.

“After three years of being a general manager at McKinsey post-HBS, I felt it was time to become an operator,” said Schoonbeek. “I gave myself a few months after leaving McKinsey to ideate on the topics that aligned with my passions and the business problems I could address based on my background.”

Meanwhile, van Poecke was closely collaborating with her portfolio companies on multiple operational initiatives and noticed trends emerging. “Most companies I worked with received an increasing amount of inbound questions for greater disclosure on their ESG performance from their lenders, shareholders and regulators, but were often ill-equipped to provide adequate data and measurement to their stakeholders,” she said.

“It also became very clear that measuring ESG performance was no longer a ‘nice-to-have’ but was mission-critical, impacting company cost of capital, share-price, reputation and the firm’s ability to attract and retain talent, amongst other things. We also observed a mind-set shift away from seeing ESG as a ‘cost-out’ to seeing it as a value creation lever. One that most businesses need to learn how to manage just as effectively as, and in alignment with, their financial performance”.

van Poecke and Schoonbeek started researching the evolution of the broader ESG market and believed there was an opportunity for them to build a business where they could:

- Help their customers unlock value while improving their impact on society.

- Put their Finance, Consulting and SaaS experience to good use.

Conversations with HBS alumni at large, mid-sized, and small companies provided the clarity they needed. Many companies did not know where to start managing ESG performance, and a knowledge gap with regards to ESG was common among senior leaders. This meant ESG was not being managed like other business goals. “Many leaders were starting to see that they needed to provide greater disclosure on how their companies were performing with regards to these issues (sustainability, lack of diversity, inequality), but they did not know how to start measuring and managing it in order to address some of the issues we see in society,” said van Poecke.

What gets measured gets managed

Having identified a clear customer need and a market opportunity, Schoonbeek and van Poecke set about building a scalable, cost-effective, and automated software solution to enable companies to manage and improve their ESG performance.

“There is no uniform set of standards for ESG, which makes it challenging for companies to effectively set ESG targets and manage improvements in the same way as you would with financial performance,” said van Poecke. Schoonbeek and van Poecke pulled from their professional and academic experience to build a software offering that enables companies to not only collect the necessary data to start measuring and managing performance, but also translates it into ESG metrics relevant to their industry. “The metrics we use are based on the latest academic research (including research from HBS professors Rebecca Henderson and George Serafeim) and on guidelines and frameworks (SASB , PRI) most commonly used in the investment industry,” said van Poecke.

In providing tools for data collection, metric calculation and the creation of ESG performance dashboards, KEY ESG allows business leaders to:

- Identify how they stack up against peers in their industry and how they are tracking against their ESG targets over time.

- Build reports for their various stakeholders (employees, shareholders, lenders, regulators) to enable them to communicate effectively and objectively on their ESG progress.

- Gain access to a manager’s toolkit that provides resources and guidance on ESG policy creation, implementation and management.

“We have decided to start building a product for which there is an urgent need amongst our target customer base as well as a willingness to pay,” said van Poecke. “Needless to say, our medium-term product vision is larger, as we think the market and customer needs will continue to evolve”.

Continuous learning is key

van Poecke had spent some time at a software business before co-founding KEY ESG, but there remains a learning curve for both co-founders as they grow their business. A learning curve they welcome.

“You can learn new things if you are open to continuous learning,” said Schoonbeek. “We’ve also been grateful for advisors and experts in our network who have helped us think through choices and have provided us with valuable feedback. We have approached this with a mindset of not being afraid to try and make mistakes. Having all those ingredients will get you going.”

“The field of ESG is evolving rapidly and becoming increasingly relevant,” van Poecke added. “ESG investing and sustainable financing are becoming mainstream, and this will create challenges and opportunities for KEY ESG. We need to continue to learn together with the rest of the market to ensure we offer our customers solutions that help them manage their sustainable advantage. It’s incredibly interesting and exciting and we are learning every day.”

Lastly, key to Schoonbeek and van Poecke’s success as partners has been the friendship that they formed at HBS. “There are definite benefits to starting a company with someone you know very well, career-wise and personally,” shared van Poecke. “It’s clear to us what our strengths are, and they’re very complimentary.”

.png)