The United Nations has set a clear global target for emissions reduction: achieving net-zero greenhouse gas emissions by 2050 to limit global temperature rise to below 2°C, ideally 1.5°C, above pre-industrial levels.

Reaching this target requires consistent reductions in Scope 1, 2, and 3 emissions across all sectors, including businesses of every size and industry.

The first step is for businesses to measure their carbon footprint. Companies must understand total emissions across all activities, including upstream and downstream operations, to contribute effectively to global climate goals. However, many organizations are unsure where to begin.

This blog outlines what a carbon footprint is and highlights the challenges companies face in measuring their own.

For expert advice and automated software to help you understand, monitor, and reduce your company’s carbon footprint, request a free KEY ESG demo.

Sustainability and carbon footprints explained

In the race to net zero, international agreements such as the Paris Agreement have helped to accelerate the rise of Environmental, Social, and Governance (ESG) investing. The environmental ‘E’ pillar of ESG is increasingly viewed as aligning business activities with the low-carbon transition.

Despite criticism from the financial sector that there are too many frameworks measuring ESG performance, one clear metric appears in all major frameworks:

The greenhouse gas emissions (GHG emissions) of a company.

This can also be described as a company's carbon footprint, defined as the amount of emissions produced by its activities. A carbon footprint is typically measured in kilograms of carbon dioxide equivalent (kg CO2-eq). This unit system allows for all greenhouse gases to be included, while accounting for their varying global warming potentials. For instance, emitting 1kg of methane is equivalent to emitting 25kg of carbon dioxide and is therefore equal to 25kg CO2-eq.

Challenges in measuring a company’s carbon footprint can vary based on the types of activities it engages in and the size of its supply chain. Companies must consider activities that both directly and indirectly contribute to the release of carbon dioxide and other greenhouse gases.

Direct emissions come from sources owned or controlled by the company, while indirect emissions result from activities outside the company's direct control, such as purchased energy or emissions across the value chain.

The Greenhouse Gas Protocol was established in 1998 to standardise this process and allow for comparability. Since then, it has published multiple standards for different entities and has gained worldwide recognition.

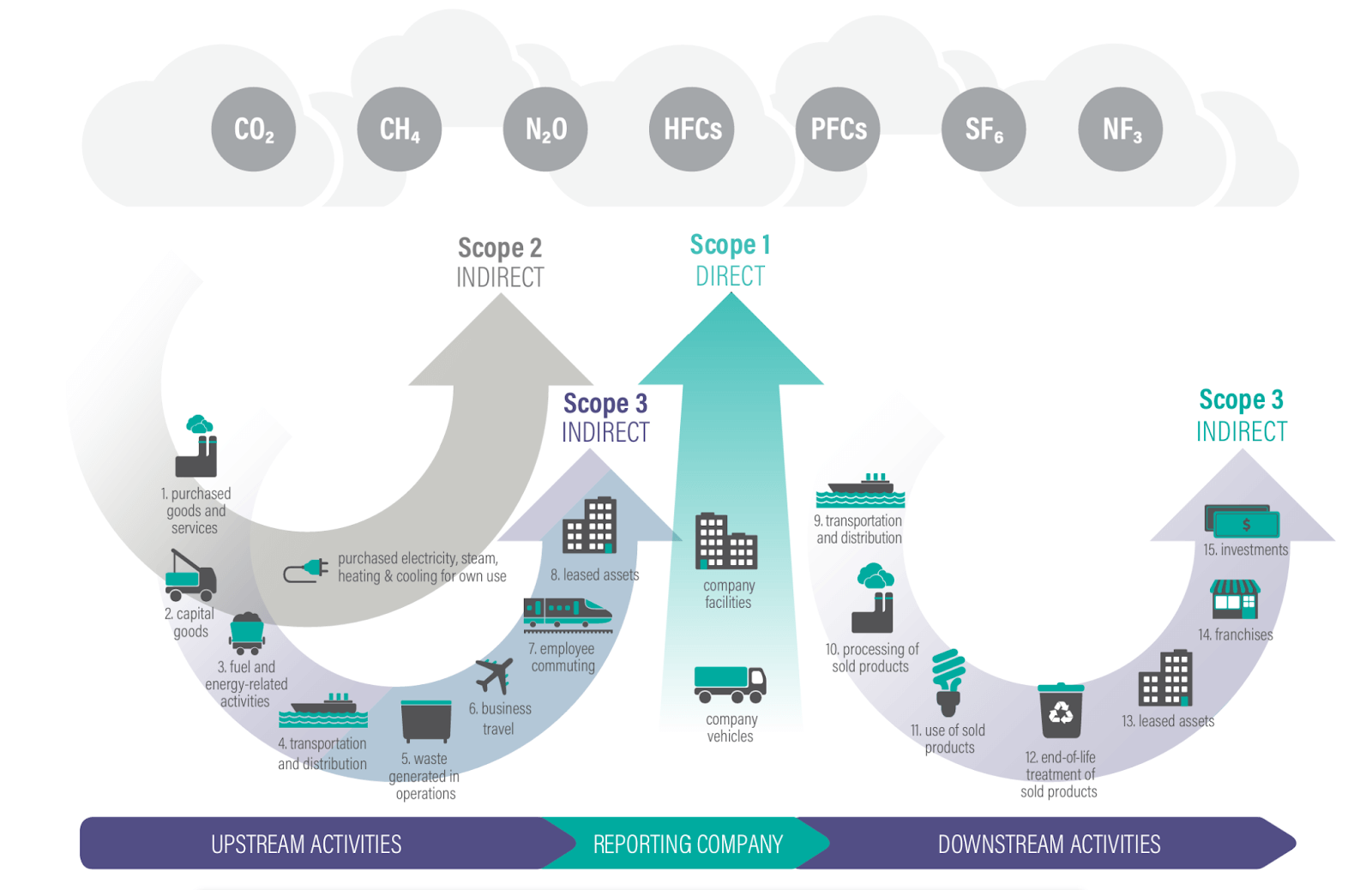

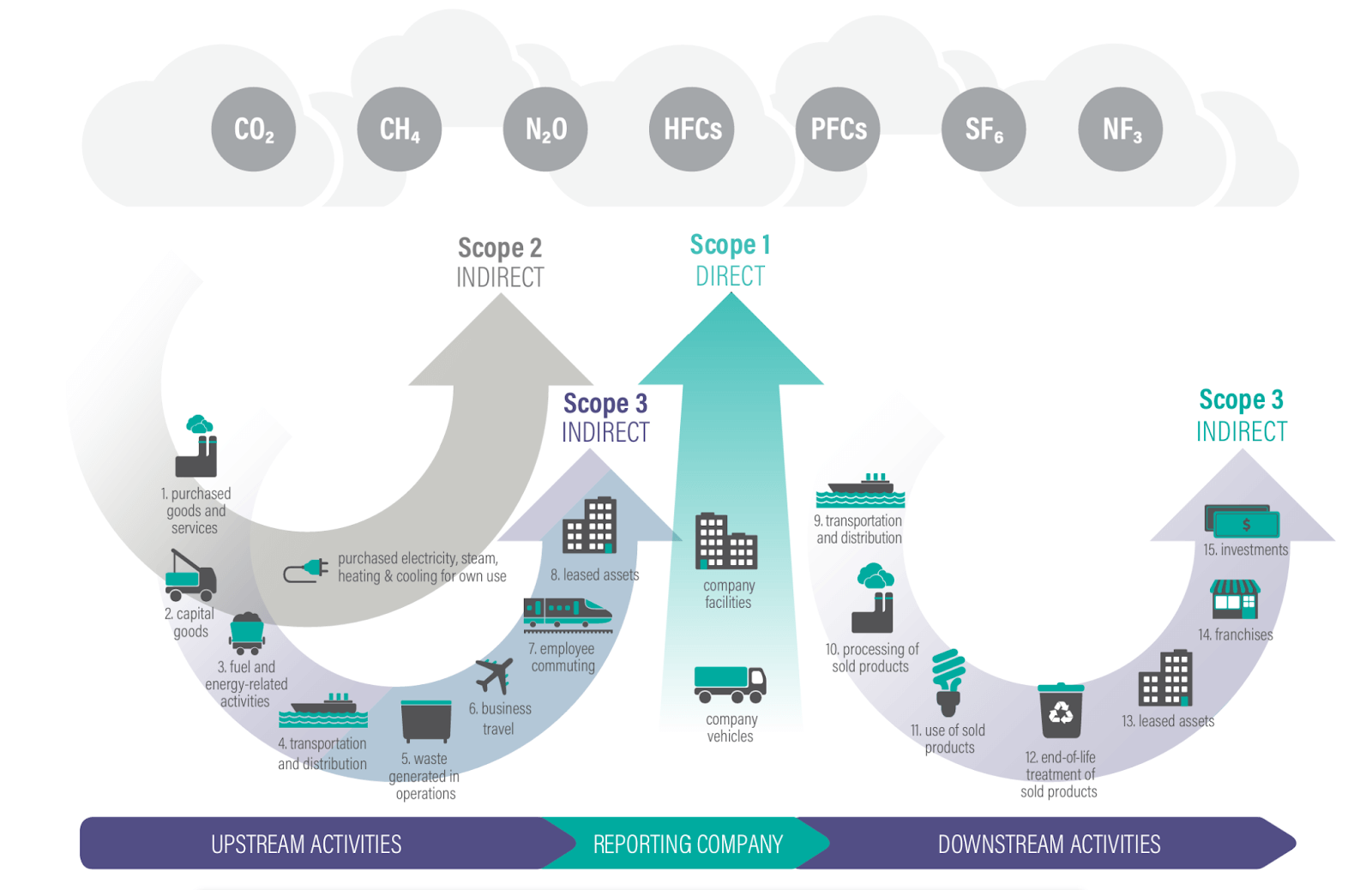

The GHG Protocol divides a company’s emissions into three scopes—1, 2, and 3—the standard framework for categorising greenhouse gas emissions.

Understanding Carbon Emissions and Emissions Scopes

Carbon emissions are the release of carbon dioxide and other greenhouse gases into the atmosphere through activities such as burning fossil fuels and other environmentally harmful processes. These emissions are categorised into three scopes based on their origin and the level of control companies have over them.

What are Scope 1 emissions?

Scope 1 emissions are direct GHG emissions from sources owned or controlled by the organisation, also known as 'owned or controlled sources'. These include both stationary and mobile sources that the organisation controls directly. Typical examples are company vehicles and vehicles owned or controlled by the company.

Scope 1 emissions result from fuel combustion and fuel burning in company-owned equipment and vehicles. Additional sources include fugitive emissions from equipment leaks and process emissions from industrial or chemical processes.

What are some examples of Scope 1 emissions?

- Fuel combustion from mobile sources

- Fuel combustion from stationary sources

- Process emissions

- Fugitive emissions

- Agricultural emissions

What are Scope 2 emissions?

Scope 2 emissions are indirect GHG emissions that arise from the generation of purchased energy, including electricity, steam, heat, or cooling obtained from external providers. They can be calculated by converting direct energy purchases into greenhouse gas emissions.

Transitioning to renewable energy sources is essential to reducing Scope 2 emissions, especially in regions where the grid relies heavily on fossil fuels. Many companies aim to achieve 100% renewable electricity use as a key milestone in decarbonising their operations.

What are some examples of Scope 2 emissions?

- Purchased electricity

- Purchased steam

- Purchased heating

- Purchased cooling

What are Scope 3 emissions?

Scope 3 emissions are other indirect emissions a company is responsible for across its value chain. Scope 3 includes upstream emissions—from suppliers, raw materials, capital goods, and production processes—and downstream emissions covering product use, disposal, and other downstream activities.

Scope 3 sources include leased assets, sold products, waste generated, waste disposal, employee commuting, and air travel. Emissions from the production processes, raw materials, and capital goods used in the company's operations are also included. Identifying emission hotspots and chain emissions within the value chain is crucial for prioritising reduction efforts. In addition, selecting suppliers with lower carbon footprints can help reduce Scope 3 emissions.

Scope 3 emissions typically account for the majority of a company's total emissions, making them critical for understanding the full impact of its emissions. For a detailed guide on Scope 3 carbon accounting, please find our whitepaper here.

What are some examples of Scope 3 emissions?

- Purchased goods and services

- Capital goods

- Fuel- and energy-related activities

- Transportation and distribution

- Waste generated in operations

- Business travel

- Employee commuting

- Leased assets

- Processing, use and end-of-life treatment of sold products

Challenges of Measuring Your Carbon Footprint

Measuring the carbon footprint of a company comes with several challenges. Listed below are three of the most common difficulties faced when measuring emissions in practice:

1. Measuring your carbon footprint for a shared office space

This is an issue for any company that occupies only part of a building. Shared workspaces have become more common in the post-COVID working environment, but utility bills for gas and electricity are usually presented for the entire building or floor.

GHG Protocol guidance suggests breaking this down to the appropriate subsection applicable to the reporting company based on the share of floor space occupied by the company.

2. Measuring your carbon footprint across different countries:

A kWh of electricity generated in one country does not produce the same amount of greenhouse gases as a kWh of electricity generated in another. This is because electricity is generated from different energy sources, each with its unique emission intensity (e.g., coal vs. wind).

KEY ESG’s reporting software uses country/region-specific emission factors to solve this issue. The GHG Protocol describes this method as a ‘location-based method’. It shows the level of clean electricity across different regions of the world.

3. Measuring your carbon footprint when working from home

Working from home is an increasingly important component of Scope 3 emissions, as the practice has become far more common in a post-COVID world. The challenges of measuring these emissions emerge when calculating what would have occurred without the employee working from home.

Assumptions included in the model developed by KEY ESG (regarding equipment power usage, working hours, heating, cooling, etc.) are based on research examining typical employee behaviour. However, these can be edited if additional direct information is available.

Reporting on Scope 1, 2, and 3 emissions

From a regulatory perspective, ESG frameworks typically require companies to report on Scope 1 and 2 emissions before mandating Scope 3 disclosures. This is because Scope 1 and 2 emissions are easier to measure. After all, the reporting company has greater control over the associated activities.

Emissions reporting is crucial for compliance and transparency, and companies are expected to develop comprehensive strategies that address all emission scopes to achieve meaningful reduction targets.

For Scope 1 and 2, emissions are calculated based on direct energy purchases, such as gas and electricity, using available activity data to estimate associated greenhouse gases.

In contrast, the complete measurement of Scope 3 emissions involves extensively assessing a company’s supply chain and upstream and downstream activities. Unlike the primary data available for Scope 1 and 2 measurements, Scope 3 measurements often rely on estimates and third-party data sources.

According to research from the Carbon Trust, Scope 3 emissions typically account for 65-95% of a company’s carbon footprint.

Figure 1 is a diagram taken from the GHG Protocol website. It represents the different possible sources of a company’s carbon footprint. KEY ESG software uses this exact category structure and methodology in its Scope 1, 2 and 3 carbon calculations.

KEY ESG’s Approach to Emissions Measurement and Reporting

As shown in Figure 1, each emission scope has been further divided into subcategories based on typical emission sources. These subcategories form the basis of the carbon footprint measurement tool created by KEY ESG, which is available in our Carbon Accounting Platform. This tool helps companies measure and report on their emissions. Leveraging our technology improves data accuracy, simplifies sustainable supply chain management and reduces emissions more effectively.

Dividing data entries according to these subcategories makes it easier for companies to enter relevant activity data. Tracking energy use across operations and understanding the emissions the company creates, directly and indirectly, are essential to identifying reduction opportunities and managing emissions efficiently. Our software then automatically converts this data to produce final emission values.

Companies that have not yet begun measuring their emissions must take this first step soon, regardless of how imperfect the initial measurements may be. From there, our software will show how measurement processes can be improved, emissions hotspots can be identified, and appropriate actions can be taken to reduce emissions, such as adopting electric vehicles for company fleets.

How to calculate Scope 1, 2 and 3 emissions

Reducing emissions across Scopes 1, 2, and 3 requires a mix of operational changes, supplier engagement, and longer-term design decisions. The most effective programmes focus first on measurement and materiality, then prioritise actions based on emissions impact, cost, and feasibility, in line with the GHG Protocol.

Below is a practical breakdown of reduction strategies by scope.

Reducing Scope 1 emissions

Scope 1 emissions come from sources an organisation owns or controls directly, such as fuel combustion and company vehicles. Reduction efforts typically focus on efficiency, fuel switching, and electrification.

Common Scope 1 reduction levers include:

- Replacing high-emission assets: Upgrade boilers, furnaces, and other combustion-based equipment to lower-emission or electric alternatives where viable.

- Shifting to lower-carbon fuels: Transition from coal or oil to natural gas, or to biogas and renewable fuels where available.

- Improving energy efficiency: Implement building retrofits, process optimisation, and preventative maintenance to reduce overall fuel consumption.

- Reducing fleet emissions: Electrify company vehicles, optimise routing, and implement fuel-efficiency standards for remaining internal-combustion engines.

- Generate on-site renewable energy: Install solar PV or other renewable systems to reduce reliance on fossil-fuel-based generation.

Reducing Scope 2 emissions

Scope 2 emissions relate to purchased electricity, heat, steam, and cooling. While indirect, they are often one of the fastest scopes to reduce through procurement and efficiency measures.

Key Scope 2 reduction strategies include:

- Improving electricity efficiency: Reduce demand through LED lighting, efficient HVAC systems, and energy-aware operational practices.

- Purchasing renewable electricity: Use green tariffs, power purchase agreements (PPAs), or energy attribute certificates, depending on market availability.

- Generating renewable energy on-site: Supplement purchased electricity with on-site solar or other renewable sources to lower grid dependence.

- Implementing energy management systems: Monitor consumption in near real-time to identify inefficiencies and track performance against reduction targets.

- Addressing transmission and distribution losses: Where relevant, factor in grid losses and prioritise local or lower-loss energy sources.

Reducing Scope 3 emissions

Scope 3 emissions occur across the value chain and are often the largest and most complex to address. Effective reduction depends on prioritising material categories and working collaboratively with suppliers, customers, and partners.

Upstream reduction strategies

Upstream emissions typically relate to purchased goods, services, and logistics.

- Procurement and materials: Replace high-emission materials with lower-carbon alternatives, embed emissions criteria into purchasing policies, and engage suppliers on reduction targets.

- Transportation and distribution: Optimise logistics, consolidate shipments, source locally where appropriate, and shift to lower-emission transport modes.

- Business travel: Reduce unnecessary travel through virtual collaboration, prioritise rail over air where feasible, and introduce travel emissions guidelines.

- Employee commuting: Support remote or hybrid working, encourage public transport and cycling, and locate offices near major transit hubs.

- Waste management: Reduce waste generation at source, improve recycling rates, and select lower-emission treatment and disposal methods.

Downstream reduction strategies

Downstream emissions are linked to how products are used and disposed of.

- Product use: Design products and services to be more energy-efficient and conduct lifecycle assessments to identify improvement opportunities.

- End-of-life treatment: Design for durability, reuse, and recyclability, and introduce take-back or refurbishment programmes where feasible.

Reducing emissions across all three scopes is an ongoing process, not a one-off exercise. Organisations that combine robust data, clear prioritisation, and continuous improvement are best positioned to achieve credible, long-term emissions reductions.

How KEY ESG helps reduce Scope 1, 2, and 3 emissions

Turning emissions reduction plans into measurable progress depends on accurate data, clear priorities, and ongoing tracking. KEY ESG supports organisations at each stage of this process, from baseline measurement through to performance improvement.

KEY ESG helps organisations reduce emissions by:

Providing a reliable emissions baseline

KEY ESG supports Scope 1, 2, and 3 carbon accounting in line with the GHG Protocol, using a library of 70,000+ emission factors from recognised sources, including DEFRA, the US EPA, and Climatiq. This allows teams to identify material sources and focus reduction efforts where they have the biggest impact.

Identifying high-impact reduction opportunities

Granular emissions breakdowns by activity, asset, supplier, and category help organisations pinpoint inefficiencies, high-emission processes, and priority Scope 3 categories.

Supporting supplier engagement for Scope 3

Structured data collection workflows and audit trails make it easier to engage suppliers, improve data quality over time, and track progress against value chain reduction initiatives.

Tracking performance against targets

Emissions data can be monitored year-on-year to assess the effectiveness of reduction measures, support internal decision-making, and demonstrate progress toward science-based or internal targets.

Enabling credible reporting and compliance

Clear, auditable outputs support reporting under frameworks such as CSRD, IFRS/ISSB, TCFD, STBi and the EU Taxonomy, helping organisations communicate reductions transparently and consistently.

By combining robust carbon accounting with practical performance insights and AI recommendations, KEY ESG enables organisations to move from emissions measurement to sustained, data-led reduction across Scopes 1, 2, and 3.

Start Measuring Your Carbon Footprint with KEY ESG

To learn more about how KEY ESG can help you measure your carbon footprint, explore the resources on our Learning and Insights page.

Our expert team is only a call or an email away and can guide you through integrating with our platform to monitor, reduce and optimise your carbon footprint.

Ready to simplify managing your carbon emissions? Get in touch or request a free demo today!

The United Nations has set a clear global target for emissions reduction: achieving net-zero greenhouse gas emissions by 2050 to limit global temperature rise to below 2°C, ideally 1.5°C, above pre-industrial levels.

Reaching this target requires consistent reductions in Scope 1, 2, and 3 emissions across all sectors, including businesses of every size and industry.

The first step is for businesses to measure their carbon footprint. Companies must understand total emissions across all activities, including upstream and downstream operations, to contribute effectively to global climate goals. However, many organizations are unsure where to begin.

This blog outlines what a carbon footprint is and highlights the challenges companies face in measuring their own.

For expert advice and automated software to help you understand, monitor, and reduce your company’s carbon footprint, request a free KEY ESG demo.

Sustainability and carbon footprints explained

In the race to net zero, international agreements such as the Paris Agreement have helped to accelerate the rise of Environmental, Social, and Governance (ESG) investing. The environmental ‘E’ pillar of ESG is increasingly viewed as aligning business activities with the low-carbon transition.

Despite criticism from the financial sector that there are too many frameworks measuring ESG performance, one clear metric appears in all major frameworks:

The greenhouse gas emissions (GHG emissions) of a company.

This can also be described as a company's carbon footprint, defined as the amount of emissions produced by its activities. A carbon footprint is typically measured in kilograms of carbon dioxide equivalent (kg CO2-eq). This unit system allows for all greenhouse gases to be included, while accounting for their varying global warming potentials. For instance, emitting 1kg of methane is equivalent to emitting 25kg of carbon dioxide and is therefore equal to 25kg CO2-eq.

Challenges in measuring a company’s carbon footprint can vary based on the types of activities it engages in and the size of its supply chain. Companies must consider activities that both directly and indirectly contribute to the release of carbon dioxide and other greenhouse gases.

Direct emissions come from sources owned or controlled by the company, while indirect emissions result from activities outside the company's direct control, such as purchased energy or emissions across the value chain.

The Greenhouse Gas Protocol was established in 1998 to standardise this process and allow for comparability. Since then, it has published multiple standards for different entities and has gained worldwide recognition.

The GHG Protocol divides a company’s emissions into three scopes—1, 2, and 3—the standard framework for categorising greenhouse gas emissions.

Understanding Carbon Emissions and Emissions Scopes

Carbon emissions are the release of carbon dioxide and other greenhouse gases into the atmosphere through activities such as burning fossil fuels and other environmentally harmful processes. These emissions are categorised into three scopes based on their origin and the level of control companies have over them.

What are Scope 1 emissions?

Scope 1 emissions are direct GHG emissions from sources owned or controlled by the organisation, also known as 'owned or controlled sources'. These include both stationary and mobile sources that the organisation controls directly. Typical examples are company vehicles and vehicles owned or controlled by the company.

Scope 1 emissions result from fuel combustion and fuel burning in company-owned equipment and vehicles. Additional sources include fugitive emissions from equipment leaks and process emissions from industrial or chemical processes.

What are some examples of Scope 1 emissions?

- Fuel combustion from mobile sources

- Fuel combustion from stationary sources

- Process emissions

- Fugitive emissions

- Agricultural emissions

What are Scope 2 emissions?

Scope 2 emissions are indirect GHG emissions that arise from the generation of purchased energy, including electricity, steam, heat, or cooling obtained from external providers. They can be calculated by converting direct energy purchases into greenhouse gas emissions.

Transitioning to renewable energy sources is essential to reducing Scope 2 emissions, especially in regions where the grid relies heavily on fossil fuels. Many companies aim to achieve 100% renewable electricity use as a key milestone in decarbonising their operations.

What are some examples of Scope 2 emissions?

- Purchased electricity

- Purchased steam

- Purchased heating

- Purchased cooling

What are Scope 3 emissions?

Scope 3 emissions are other indirect emissions a company is responsible for across its value chain. Scope 3 includes upstream emissions—from suppliers, raw materials, capital goods, and production processes—and downstream emissions covering product use, disposal, and other downstream activities.

Scope 3 sources include leased assets, sold products, waste generated, waste disposal, employee commuting, and air travel. Emissions from the production processes, raw materials, and capital goods used in the company's operations are also included. Identifying emission hotspots and chain emissions within the value chain is crucial for prioritising reduction efforts. In addition, selecting suppliers with lower carbon footprints can help reduce Scope 3 emissions.

Scope 3 emissions typically account for the majority of a company's total emissions, making them critical for understanding the full impact of its emissions. For a detailed guide on Scope 3 carbon accounting, please find our whitepaper here.

What are some examples of Scope 3 emissions?

- Purchased goods and services

- Capital goods

- Fuel- and energy-related activities

- Transportation and distribution

- Waste generated in operations

- Business travel

- Employee commuting

- Leased assets

- Processing, use and end-of-life treatment of sold products

Challenges of Measuring Your Carbon Footprint

Measuring the carbon footprint of a company comes with several challenges. Listed below are three of the most common difficulties faced when measuring emissions in practice:

1. Measuring your carbon footprint for a shared office space

This is an issue for any company that occupies only part of a building. Shared workspaces have become more common in the post-COVID working environment, but utility bills for gas and electricity are usually presented for the entire building or floor.

GHG Protocol guidance suggests breaking this down to the appropriate subsection applicable to the reporting company based on the share of floor space occupied by the company.

2. Measuring your carbon footprint across different countries:

A kWh of electricity generated in one country does not produce the same amount of greenhouse gases as a kWh of electricity generated in another. This is because electricity is generated from different energy sources, each with its unique emission intensity (e.g., coal vs. wind).

KEY ESG’s reporting software uses country/region-specific emission factors to solve this issue. The GHG Protocol describes this method as a ‘location-based method’. It shows the level of clean electricity across different regions of the world.

3. Measuring your carbon footprint when working from home

Working from home is an increasingly important component of Scope 3 emissions, as the practice has become far more common in a post-COVID world. The challenges of measuring these emissions emerge when calculating what would have occurred without the employee working from home.

Assumptions included in the model developed by KEY ESG (regarding equipment power usage, working hours, heating, cooling, etc.) are based on research examining typical employee behaviour. However, these can be edited if additional direct information is available.

Reporting on Scope 1, 2, and 3 emissions

From a regulatory perspective, ESG frameworks typically require companies to report on Scope 1 and 2 emissions before mandating Scope 3 disclosures. This is because Scope 1 and 2 emissions are easier to measure. After all, the reporting company has greater control over the associated activities.

Emissions reporting is crucial for compliance and transparency, and companies are expected to develop comprehensive strategies that address all emission scopes to achieve meaningful reduction targets.

For Scope 1 and 2, emissions are calculated based on direct energy purchases, such as gas and electricity, using available activity data to estimate associated greenhouse gases.

In contrast, the complete measurement of Scope 3 emissions involves extensively assessing a company’s supply chain and upstream and downstream activities. Unlike the primary data available for Scope 1 and 2 measurements, Scope 3 measurements often rely on estimates and third-party data sources.

According to research from the Carbon Trust, Scope 3 emissions typically account for 65-95% of a company’s carbon footprint.

Figure 1 is a diagram taken from the GHG Protocol website. It represents the different possible sources of a company’s carbon footprint. KEY ESG software uses this exact category structure and methodology in its Scope 1, 2 and 3 carbon calculations.

KEY ESG’s Approach to Emissions Measurement and Reporting

As shown in Figure 1, each emission scope has been further divided into subcategories based on typical emission sources. These subcategories form the basis of the carbon footprint measurement tool created by KEY ESG, which is available in our Carbon Accounting Platform. This tool helps companies measure and report on their emissions. Leveraging our technology improves data accuracy, simplifies sustainable supply chain management and reduces emissions more effectively.

Dividing data entries according to these subcategories makes it easier for companies to enter relevant activity data. Tracking energy use across operations and understanding the emissions the company creates, directly and indirectly, are essential to identifying reduction opportunities and managing emissions efficiently. Our software then automatically converts this data to produce final emission values.

Companies that have not yet begun measuring their emissions must take this first step soon, regardless of how imperfect the initial measurements may be. From there, our software will show how measurement processes can be improved, emissions hotspots can be identified, and appropriate actions can be taken to reduce emissions, such as adopting electric vehicles for company fleets.

How to calculate Scope 1, 2 and 3 emissions

Reducing emissions across Scopes 1, 2, and 3 requires a mix of operational changes, supplier engagement, and longer-term design decisions. The most effective programmes focus first on measurement and materiality, then prioritise actions based on emissions impact, cost, and feasibility, in line with the GHG Protocol.

Below is a practical breakdown of reduction strategies by scope.

Reducing Scope 1 emissions

Scope 1 emissions come from sources an organisation owns or controls directly, such as fuel combustion and company vehicles. Reduction efforts typically focus on efficiency, fuel switching, and electrification.

Common Scope 1 reduction levers include:

- Replacing high-emission assets: Upgrade boilers, furnaces, and other combustion-based equipment to lower-emission or electric alternatives where viable.

- Shifting to lower-carbon fuels: Transition from coal or oil to natural gas, or to biogas and renewable fuels where available.

- Improving energy efficiency: Implement building retrofits, process optimisation, and preventative maintenance to reduce overall fuel consumption.

- Reducing fleet emissions: Electrify company vehicles, optimise routing, and implement fuel-efficiency standards for remaining internal-combustion engines.

- Generate on-site renewable energy: Install solar PV or other renewable systems to reduce reliance on fossil-fuel-based generation.

Reducing Scope 2 emissions

Scope 2 emissions relate to purchased electricity, heat, steam, and cooling. While indirect, they are often one of the fastest scopes to reduce through procurement and efficiency measures.

Key Scope 2 reduction strategies include:

- Improving electricity efficiency: Reduce demand through LED lighting, efficient HVAC systems, and energy-aware operational practices.

- Purchasing renewable electricity: Use green tariffs, power purchase agreements (PPAs), or energy attribute certificates, depending on market availability.

- Generating renewable energy on-site: Supplement purchased electricity with on-site solar or other renewable sources to lower grid dependence.

- Implementing energy management systems: Monitor consumption in near real-time to identify inefficiencies and track performance against reduction targets.

- Addressing transmission and distribution losses: Where relevant, factor in grid losses and prioritise local or lower-loss energy sources.

Reducing Scope 3 emissions

Scope 3 emissions occur across the value chain and are often the largest and most complex to address. Effective reduction depends on prioritising material categories and working collaboratively with suppliers, customers, and partners.

Upstream reduction strategies

Upstream emissions typically relate to purchased goods, services, and logistics.

- Procurement and materials: Replace high-emission materials with lower-carbon alternatives, embed emissions criteria into purchasing policies, and engage suppliers on reduction targets.

- Transportation and distribution: Optimise logistics, consolidate shipments, source locally where appropriate, and shift to lower-emission transport modes.

- Business travel: Reduce unnecessary travel through virtual collaboration, prioritise rail over air where feasible, and introduce travel emissions guidelines.

- Employee commuting: Support remote or hybrid working, encourage public transport and cycling, and locate offices near major transit hubs.

- Waste management: Reduce waste generation at source, improve recycling rates, and select lower-emission treatment and disposal methods.

Downstream reduction strategies

Downstream emissions are linked to how products are used and disposed of.

- Product use: Design products and services to be more energy-efficient and conduct lifecycle assessments to identify improvement opportunities.

- End-of-life treatment: Design for durability, reuse, and recyclability, and introduce take-back or refurbishment programmes where feasible.

Reducing emissions across all three scopes is an ongoing process, not a one-off exercise. Organisations that combine robust data, clear prioritisation, and continuous improvement are best positioned to achieve credible, long-term emissions reductions.

How KEY ESG helps reduce Scope 1, 2, and 3 emissions

Turning emissions reduction plans into measurable progress depends on accurate data, clear priorities, and ongoing tracking. KEY ESG supports organisations at each stage of this process, from baseline measurement through to performance improvement.

KEY ESG helps organisations reduce emissions by:

Providing a reliable emissions baseline

KEY ESG supports Scope 1, 2, and 3 carbon accounting in line with the GHG Protocol, using a library of 70,000+ emission factors from recognised sources, including DEFRA, the US EPA, and Climatiq. This allows teams to identify material sources and focus reduction efforts where they have the biggest impact.

Identifying high-impact reduction opportunities

Granular emissions breakdowns by activity, asset, supplier, and category help organisations pinpoint inefficiencies, high-emission processes, and priority Scope 3 categories.

Supporting supplier engagement for Scope 3

Structured data collection workflows and audit trails make it easier to engage suppliers, improve data quality over time, and track progress against value chain reduction initiatives.

Tracking performance against targets

Emissions data can be monitored year-on-year to assess the effectiveness of reduction measures, support internal decision-making, and demonstrate progress toward science-based or internal targets.

Enabling credible reporting and compliance

Clear, auditable outputs support reporting under frameworks such as CSRD, IFRS/ISSB, TCFD, STBi and the EU Taxonomy, helping organisations communicate reductions transparently and consistently.

By combining robust carbon accounting with practical performance insights and AI recommendations, KEY ESG enables organisations to move from emissions measurement to sustained, data-led reduction across Scopes 1, 2, and 3.

Start Measuring Your Carbon Footprint with KEY ESG

To learn more about how KEY ESG can help you measure your carbon footprint, explore the resources on our Learning and Insights page.

Our expert team is only a call or an email away and can guide you through integrating with our platform to monitor, reduce and optimise your carbon footprint.

Ready to simplify managing your carbon emissions? Get in touch or request a free demo today!