Sustainability considerations and Environmental, Social, and Governance (ESG) compliance have evolved from optional to essential in today’s business landscape. Industries globally are increasingly recognizing the value of integrating ESG principles into their core operations. This transition goes beyond reputation management; it’s about driving sustainable growth, creating long-term value for stakeholders, and contributing to a more sustainable future.

As consumer demand for responsible business practices grows, ESG goals and initiatives are becoming critical drivers of success, enabled by technological innovations and supported by evolving regulations. At KEY ESG, we've crafted a comprehensive guide to help you navigate the complex world of ESG management tools, ensuring you select solutions that align with your business’s sustainability objectives.

Key ESG Statistics to Know in 2025

Understanding KEY ESG statistics is vital for CFOs, Chief Sustainability Officers,, Heads of Sustainability, and other decision-makers. These statistics are not just numbers; they represent a shift in how companies operate and invest.

With the demand for ESG investments outstripping supply, it’s clear that sustainability is no longer a niche concern but a mainstream business imperative.

- Currently, 90% of S&P 500 companies release ESG reports. (2)

- Currently, 90% of S&P 500 companies release ESG reports, with many focusing on the impact of climate change on their operations and strategies.

- Global consumers increasingly recognise the importance of sustainability in their shopping habits, suggesting a shift towards greener purchasing decisions.

- Thirty percent of investors claim they have difficulty finding suitable and appealing ESG investing options, despite the market’s explosive growth in ESG investment products. (1)

- Consumer attitudes towards sustainability vary by region and influence purchasing decisions, with significant regional differences regarding environmental consciousness.

- ESG-focused institutional investments are projected to reach $33.9 trillion by 2026. (1)

- 83% of consumers believe companies should actively shape ESG best practices. (3)

- Investment funds with adherence to ESG principles hold more than $18 trillion, reflecting a significant increase in sustainability investments. (1)

- Companies increasingly prioritise and examine their environmental impact and enhance sustainability, particularly in reducing carbon emissions. (4)

- There is a strong relationship between sustainability initiatives and improved financial performance, with businesses recognizing long-term benefits such as enhanced reputation, reduced risks, and increased revenue.

- ESG is considered by 89% of investors when making investment decisions. (5)

- ESG investments are expected to constitute over 20% of assets under management by 2026 (1)

The Impact of Sustainability Investment on Business Growth

The influence of ESG practices on businesses is significant, a fact that CFOs, Heads of Sustainability, and decision-makers must recognise. ESG practices help reduce businesses' carbon footprint, making them more sustainable and appealing to environmentally conscious consumers.

The following statistics underscore the growing importance of ESG in corporate strategy:

- A staggering 76% of consumers would cease buying from firms that neglect environmental, employee, or community well-being, highlighting the direct impact of ESG practices on consumer behaviour. (6)

- Currently, 53% of the income for the top 500 U.S. corporations and 49% of the earnings for the largest 1,200 companies worldwide come from business operations that contribute to the Sustainable Development Goals (SDGs), highlighting the importance of corporate sustainability. (7)

- Reducing greenhouse gas emissions is crucial in corporate sustainability strategies, as it helps mitigate climate change and aligns with global efforts to limit economic losses associated with climate impacts.

- 88% of consumers demonstrate increased loyalty to businesses that advocate for social or environmental issues. (19)

- By the year 2026, it is expected that climate-related weather events will cost suppliers a staggering $1.3 trillion. (8)

- Companies that excel in employee satisfaction often have ESG ratings that are 14% higher than the global average, likely due to their impressive environmental initiatives. (9)

- Companies with higher ESG scores experience lower capital costs, according to 50.1% of investors, reflecting the growing significance of sustainable finance. (10)

- Europe leads in the ESG investment market with 83% of all ESG assets. At the same time, investors in North America tend to be more cautious about sustainability-focused investments, particularly in areas like energy efficiency. (11)

- Investing in renewable energy is crucial to ESG initiatives, as it significantly reduces emissions and supports long-term corporate sustainability.

- 88% of public companies have established ESG initiatives. (5)

- More European investors consider ESG integral to their investment approach. (18)

- Numerous companies across different regions and sectors are leveraging sustainability criteria not only for societal impact but also to gain additional financial advantages. (2)

- A significant 79% of investors consider how a company handles ESG risks and opportunities as crucial in their investment choices, with 76% using a company's ESG risk and opportunity profile to filter out potential investments. (23)

- 59% indicate that a company's failure to address sustainability issues likely leads them to vote against its executive pay agreement. (23)

The Role of Mandatory ESG Reporting in Shaping Stakeholder Decisions

For CFOs, Heads of Sustainability, and other key stakeholders, understanding how investors view ESG in their decision-making is crucial. This highlights difficulties in aligning the ESG reporting process and the need for solutions to make it easy for investors to report under multiple frameworks.

- 72% of European asset owners who receive ESG reports from managers desire standardised reports, yet only 18% can implement this, highlighting the importance of addressing material sustainability concerns. (12)

- By 2025, ESG-mandated assets are projected to represent half of all professionally managed investments, totaling around $35 trillion. (13)

- An overwhelming 90% of public companies have adopted sustainability reporting to secure investor confidence. (10)

- 70% of supply chain experts predict that there will be greater pressure from investors for improved sustainability reporting and transparency. (10)

- Governmental entities have increased the issuance of ESG reporting guidelines by 74% over the past four years, emphasizing the role of regulatory compliance in sustainability reporting. (14)

- Nearly 80% of investors say that ESG is critical for their investment decisions. (15)

- Younger investors are more interested in ESG issues than their older counterparts. (11)

- More than half of global investors believe that clarity regarding sustainability’s role in a fund’s investment strategy is a crucial aspect of reporting, particularly regarding supply chain sustainability. (5)

- Young investors, possessing over $250,000, expressed willingness to forgo 14% of their wealth to further sustainability issues. (5)

- A significant 85% of asset managers report that ESG considerations are a top priority within their companies. (4)

- 91% of corporate leaders acknowledge their company's duty to address sustainability issues. (6)

- Investors' expectations for ESG returns and their reasons for making ESG investments vary widely. (20)

- Meaningful ESG holdings are only found among investors who anticipate outperforming the market, even those who stated that hedging or ethical concerns were their primary motivations for ESG investing. (20)

- 53% of global respondents believe the two most significant obstacles to adopting sustainable investing are “poor quality or availability of ESG data and analytics” and “poor quality of sustainability investment reporting.” (21)

- In 2021, nearly half of the institutional investors from around the world who responded said they adopted sustainability to make their investments match their organisation's values. (22)

- A third of these investors started using ESG either to change how companies act or because their investment rules required it. (22)

- Only a third (33%) of investors surveyed believe the ESG reports they see are of good quality, and less than half (40%) trust the ESG ratings and scores they receive. (23)

- 82% of investors feel that sustainability should be an integral part of a company’s strategy. Additionally, 66% are more reassured that ESG concerns are managed when a C-suite executive is responsible. (23)

Overcoming Challenges in Implementing ESG Initiatives

For CFOs, Heads of Sustainability, and other business leaders, understanding the challenges of implementing ESG initiatives is crucial. About 24% of companies identify internal corporate silos as significant barriers to advancing their ESG agendas. This statistic highlights the organisational challenges that can impede the integration of sustainable practices.

- 71% of chief executives take personal responsibility for ensuring their company’s ESG strategies align with their customers’ values, often incorporating circular economy principles to reduce waste and optimise resources. (16)

- Employee activism is increasingly shaping organizational sustainability efforts, with a significant percentage of business leaders influenced by their employees' activism. Younger workers, in particular, are driving positive change within their companies, which correlates with the importance of sustainability to job seekers.

- Only half of the firms are confident in their robust performance in environmental aspects. (17)

- Key challenges in ESG investment include concerns about performance, a lack of comprehensive data, and fears of greenwashing, particularly in areas such as global deforestation and its impact on biodiversity. (11)

- The importance of protecting natural resources is emphasized in the context of environmental challenges. Issues like climate change, deforestation, and resource scarcity are interconnected, leading to urgent calls for action to protect these resources for ecological and economic stability.

- Although many leaders acknowledge the long-term advantages of ESG, 40% admit the continuous difficulty in balancing growth objectives with ESG commitments, often requiring significant technological advancements to achieve these goals. (6)

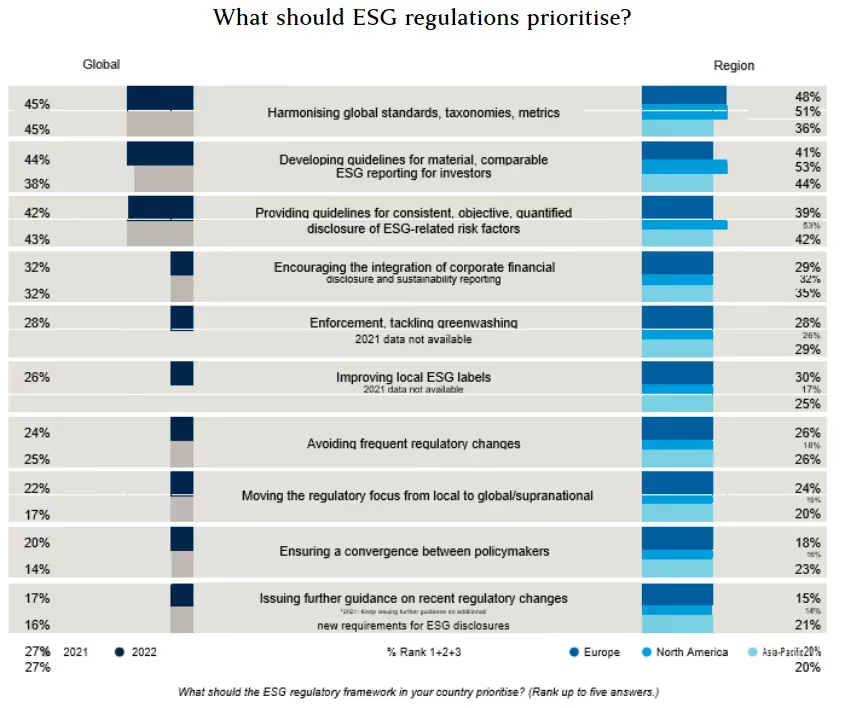

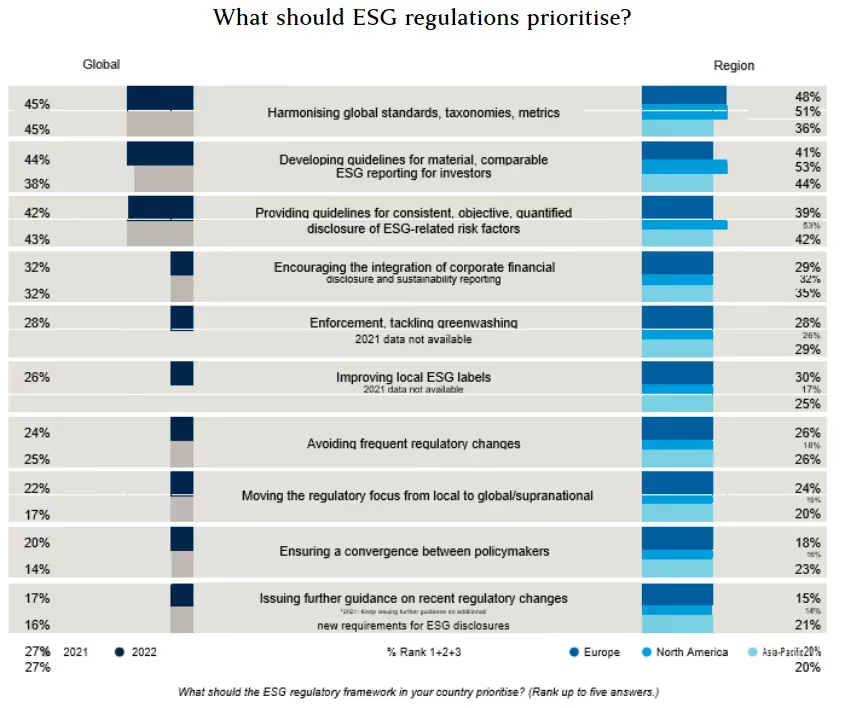

- 37% of executives highlight the lack of consistent reporting standards and the complexity involved as major obstacles in dealing with ESG issues. (6)

- About 46% of investors highlight the lack of comprehensive ESG data as a significant challenge. (5)

- The primary challenge for global investors in ESG investments is the inconsistency in scores from different ESG rating providers, as indicated by 25% of them. (18)

- North American investors, in a higher proportion, emphasise the need for unified global standards (51%), the creation of ESG reporting guidelines (53%), and the disclosure of ESG risk factors (53%). (18)

- 88% of institutional investors surveyed express that asset managers should take a more active role in creating new ESG-focused products. (1)

- In 2021, 37% of market issuers and institutional investors worldwide said insufficiently skilled people were the main problem with increasing ESG investments. (22)

- A 2021 survey found that 40% of executives in the US, Brazil, the UK, Germany, and India thought the biggest challenge for ESG was balancing it with their growth goals. (22)

Conclusion: Key Takeaways on Environmental Sustainability Trends

Sustainability is not just a trend but a fundamental shift in how businesses operate and strategise. For CFOs, CSOs and heads of sustainability, these statistics underscore the importance of integrating ESG into corporate ethos. From consumer preferences to investment decisions, establishing an environmentally sustainable company is critical in today’s business landscape, offering challenges and opportunities through various sustainability efforts.

Navigating this ESG-centric world requires tools and insights to turn sustainability goals into actionable business strategies. Organisations must, among other things, better manage their global carbon emissions and include social and economic costs in their budgets to maintain sustainability.

This is where KEY ESG steps in, offering a platform that simplifies and enhances sustainability management. For leaders looking to make informed, sustainable decisions, gain a competitive edge, and easily report under all relevant frameworks, exploring KEY ESG’s solutions is a step in the right direction.

To explore sustainability more deeply and learn how KEY ESG can help you, request a demo and explore more insights on our Learning and Insights page. We will guide you through adopting and maintaining sustainability practices, securing your business's future.

References

- ESG-focused institutional investment seen soaring 84% to US$33.9 trillion in 2026, making up 21.5% of assets under management (PWC)

- Does ESG really matter—and why? (McKinsey)

- ESG Services and Strategies (PWC)

- 25 ESG Statistics You Need to Know in 2023 (Perillon)

- ESG investing statistics 2023 (Bankrate)

- Beyond compliance: Consumers and employees want business to do more on ESG (PWC)

- The State of Green Business 2021 Positive Impact (S&P Global)

- Beyond Good Intentions: The Tangible Business Case for ESG-Focused Procurement (Supplier.io)

- ESG as a work strategy (Marshmclennan)

- 50 ESG & Sustainability Facts & Statistics [2025] (DigitalDefynd)

- ESG Investing Statistics, Data & Trends (2025) (Investing in the Web)

- How Ready is Europe for the ESG Revolution? (Clearwater Analytics)

- Advancing environmental, social, and governance investing (Deloitte)

- SUSTAINABILITY REPORTING POLICY: Global trends in disclosure as the ESG agenda goes mainstream(Carrots & Sticks)

- The economic realities of ESG (PWC)

- The numbers that are changing the world (KPMG)

- Global Survey Finds Businesses Increasing ESG Commitments, Spending (Navex)

- ESG Global Study 2022 (Harvard)

- 88% Of Consumers Want You To Help Them Make A Difference (Forbes)

- Four Facts About ESG Beliefs and Investor Portfolios (NBER)

- Globally Consistent ESG Reporting (Deloitte)

- ESG investing - statistics & facts (Statista)

- PwC: ‘Only 29% of investors say current company reporting adequately describes ESG’s impact on business performance’ (PWC)

Sustainability considerations and Environmental, Social, and Governance (ESG) compliance have evolved from optional to essential in today’s business landscape. Industries globally are increasingly recognizing the value of integrating ESG principles into their core operations. This transition goes beyond reputation management; it’s about driving sustainable growth, creating long-term value for stakeholders, and contributing to a more sustainable future.

As consumer demand for responsible business practices grows, ESG goals and initiatives are becoming critical drivers of success, enabled by technological innovations and supported by evolving regulations. At KEY ESG, we've crafted a comprehensive guide to help you navigate the complex world of ESG management tools, ensuring you select solutions that align with your business’s sustainability objectives.

Key ESG Statistics to Know in 2025

Understanding KEY ESG statistics is vital for CFOs, Chief Sustainability Officers,, Heads of Sustainability, and other decision-makers. These statistics are not just numbers; they represent a shift in how companies operate and invest.

With the demand for ESG investments outstripping supply, it’s clear that sustainability is no longer a niche concern but a mainstream business imperative.

- Currently, 90% of S&P 500 companies release ESG reports. (2)

- Currently, 90% of S&P 500 companies release ESG reports, with many focusing on the impact of climate change on their operations and strategies.

- Global consumers increasingly recognise the importance of sustainability in their shopping habits, suggesting a shift towards greener purchasing decisions.

- Thirty percent of investors claim they have difficulty finding suitable and appealing ESG investing options, despite the market’s explosive growth in ESG investment products. (1)

- Consumer attitudes towards sustainability vary by region and influence purchasing decisions, with significant regional differences regarding environmental consciousness.

- ESG-focused institutional investments are projected to reach $33.9 trillion by 2026. (1)

- 83% of consumers believe companies should actively shape ESG best practices. (3)

- Investment funds with adherence to ESG principles hold more than $18 trillion, reflecting a significant increase in sustainability investments. (1)

- Companies increasingly prioritise and examine their environmental impact and enhance sustainability, particularly in reducing carbon emissions. (4)

- There is a strong relationship between sustainability initiatives and improved financial performance, with businesses recognizing long-term benefits such as enhanced reputation, reduced risks, and increased revenue.

- ESG is considered by 89% of investors when making investment decisions. (5)

- ESG investments are expected to constitute over 20% of assets under management by 2026 (1)

The Impact of Sustainability Investment on Business Growth

The influence of ESG practices on businesses is significant, a fact that CFOs, Heads of Sustainability, and decision-makers must recognise. ESG practices help reduce businesses' carbon footprint, making them more sustainable and appealing to environmentally conscious consumers.

The following statistics underscore the growing importance of ESG in corporate strategy:

- A staggering 76% of consumers would cease buying from firms that neglect environmental, employee, or community well-being, highlighting the direct impact of ESG practices on consumer behaviour. (6)

- Currently, 53% of the income for the top 500 U.S. corporations and 49% of the earnings for the largest 1,200 companies worldwide come from business operations that contribute to the Sustainable Development Goals (SDGs), highlighting the importance of corporate sustainability. (7)

- Reducing greenhouse gas emissions is crucial in corporate sustainability strategies, as it helps mitigate climate change and aligns with global efforts to limit economic losses associated with climate impacts.

- 88% of consumers demonstrate increased loyalty to businesses that advocate for social or environmental issues. (19)

- By the year 2026, it is expected that climate-related weather events will cost suppliers a staggering $1.3 trillion. (8)

- Companies that excel in employee satisfaction often have ESG ratings that are 14% higher than the global average, likely due to their impressive environmental initiatives. (9)

- Companies with higher ESG scores experience lower capital costs, according to 50.1% of investors, reflecting the growing significance of sustainable finance. (10)

- Europe leads in the ESG investment market with 83% of all ESG assets. At the same time, investors in North America tend to be more cautious about sustainability-focused investments, particularly in areas like energy efficiency. (11)

- Investing in renewable energy is crucial to ESG initiatives, as it significantly reduces emissions and supports long-term corporate sustainability.

- 88% of public companies have established ESG initiatives. (5)

- More European investors consider ESG integral to their investment approach. (18)

- Numerous companies across different regions and sectors are leveraging sustainability criteria not only for societal impact but also to gain additional financial advantages. (2)

- A significant 79% of investors consider how a company handles ESG risks and opportunities as crucial in their investment choices, with 76% using a company's ESG risk and opportunity profile to filter out potential investments. (23)

- 59% indicate that a company's failure to address sustainability issues likely leads them to vote against its executive pay agreement. (23)

The Role of Mandatory ESG Reporting in Shaping Stakeholder Decisions

For CFOs, Heads of Sustainability, and other key stakeholders, understanding how investors view ESG in their decision-making is crucial. This highlights difficulties in aligning the ESG reporting process and the need for solutions to make it easy for investors to report under multiple frameworks.

- 72% of European asset owners who receive ESG reports from managers desire standardised reports, yet only 18% can implement this, highlighting the importance of addressing material sustainability concerns. (12)

- By 2025, ESG-mandated assets are projected to represent half of all professionally managed investments, totaling around $35 trillion. (13)

- An overwhelming 90% of public companies have adopted sustainability reporting to secure investor confidence. (10)

- 70% of supply chain experts predict that there will be greater pressure from investors for improved sustainability reporting and transparency. (10)

- Governmental entities have increased the issuance of ESG reporting guidelines by 74% over the past four years, emphasizing the role of regulatory compliance in sustainability reporting. (14)

- Nearly 80% of investors say that ESG is critical for their investment decisions. (15)

- Younger investors are more interested in ESG issues than their older counterparts. (11)

- More than half of global investors believe that clarity regarding sustainability’s role in a fund’s investment strategy is a crucial aspect of reporting, particularly regarding supply chain sustainability. (5)

- Young investors, possessing over $250,000, expressed willingness to forgo 14% of their wealth to further sustainability issues. (5)

- A significant 85% of asset managers report that ESG considerations are a top priority within their companies. (4)

- 91% of corporate leaders acknowledge their company's duty to address sustainability issues. (6)

- Investors' expectations for ESG returns and their reasons for making ESG investments vary widely. (20)

- Meaningful ESG holdings are only found among investors who anticipate outperforming the market, even those who stated that hedging or ethical concerns were their primary motivations for ESG investing. (20)

- 53% of global respondents believe the two most significant obstacles to adopting sustainable investing are “poor quality or availability of ESG data and analytics” and “poor quality of sustainability investment reporting.” (21)

- In 2021, nearly half of the institutional investors from around the world who responded said they adopted sustainability to make their investments match their organisation's values. (22)

- A third of these investors started using ESG either to change how companies act or because their investment rules required it. (22)

- Only a third (33%) of investors surveyed believe the ESG reports they see are of good quality, and less than half (40%) trust the ESG ratings and scores they receive. (23)

- 82% of investors feel that sustainability should be an integral part of a company’s strategy. Additionally, 66% are more reassured that ESG concerns are managed when a C-suite executive is responsible. (23)

Overcoming Challenges in Implementing ESG Initiatives

For CFOs, Heads of Sustainability, and other business leaders, understanding the challenges of implementing ESG initiatives is crucial. About 24% of companies identify internal corporate silos as significant barriers to advancing their ESG agendas. This statistic highlights the organisational challenges that can impede the integration of sustainable practices.

- 71% of chief executives take personal responsibility for ensuring their company’s ESG strategies align with their customers’ values, often incorporating circular economy principles to reduce waste and optimise resources. (16)

- Employee activism is increasingly shaping organizational sustainability efforts, with a significant percentage of business leaders influenced by their employees' activism. Younger workers, in particular, are driving positive change within their companies, which correlates with the importance of sustainability to job seekers.

- Only half of the firms are confident in their robust performance in environmental aspects. (17)

- Key challenges in ESG investment include concerns about performance, a lack of comprehensive data, and fears of greenwashing, particularly in areas such as global deforestation and its impact on biodiversity. (11)

- The importance of protecting natural resources is emphasized in the context of environmental challenges. Issues like climate change, deforestation, and resource scarcity are interconnected, leading to urgent calls for action to protect these resources for ecological and economic stability.

- Although many leaders acknowledge the long-term advantages of ESG, 40% admit the continuous difficulty in balancing growth objectives with ESG commitments, often requiring significant technological advancements to achieve these goals. (6)

- 37% of executives highlight the lack of consistent reporting standards and the complexity involved as major obstacles in dealing with ESG issues. (6)

- About 46% of investors highlight the lack of comprehensive ESG data as a significant challenge. (5)

- The primary challenge for global investors in ESG investments is the inconsistency in scores from different ESG rating providers, as indicated by 25% of them. (18)

- North American investors, in a higher proportion, emphasise the need for unified global standards (51%), the creation of ESG reporting guidelines (53%), and the disclosure of ESG risk factors (53%). (18)

- 88% of institutional investors surveyed express that asset managers should take a more active role in creating new ESG-focused products. (1)

- In 2021, 37% of market issuers and institutional investors worldwide said insufficiently skilled people were the main problem with increasing ESG investments. (22)

- A 2021 survey found that 40% of executives in the US, Brazil, the UK, Germany, and India thought the biggest challenge for ESG was balancing it with their growth goals. (22)

Conclusion: Key Takeaways on Environmental Sustainability Trends

Sustainability is not just a trend but a fundamental shift in how businesses operate and strategise. For CFOs, CSOs and heads of sustainability, these statistics underscore the importance of integrating ESG into corporate ethos. From consumer preferences to investment decisions, establishing an environmentally sustainable company is critical in today’s business landscape, offering challenges and opportunities through various sustainability efforts.

Navigating this ESG-centric world requires tools and insights to turn sustainability goals into actionable business strategies. Organisations must, among other things, better manage their global carbon emissions and include social and economic costs in their budgets to maintain sustainability.

This is where KEY ESG steps in, offering a platform that simplifies and enhances sustainability management. For leaders looking to make informed, sustainable decisions, gain a competitive edge, and easily report under all relevant frameworks, exploring KEY ESG’s solutions is a step in the right direction.

To explore sustainability more deeply and learn how KEY ESG can help you, request a demo and explore more insights on our Learning and Insights page. We will guide you through adopting and maintaining sustainability practices, securing your business's future.

References

- ESG-focused institutional investment seen soaring 84% to US$33.9 trillion in 2026, making up 21.5% of assets under management (PWC)

- Does ESG really matter—and why? (McKinsey)

- ESG Services and Strategies (PWC)

- 25 ESG Statistics You Need to Know in 2023 (Perillon)

- ESG investing statistics 2023 (Bankrate)

- Beyond compliance: Consumers and employees want business to do more on ESG (PWC)

- The State of Green Business 2021 Positive Impact (S&P Global)

- Beyond Good Intentions: The Tangible Business Case for ESG-Focused Procurement (Supplier.io)

- ESG as a work strategy (Marshmclennan)

- 50 ESG & Sustainability Facts & Statistics [2025] (DigitalDefynd)

- ESG Investing Statistics, Data & Trends (2025) (Investing in the Web)

- How Ready is Europe for the ESG Revolution? (Clearwater Analytics)

- Advancing environmental, social, and governance investing (Deloitte)

- SUSTAINABILITY REPORTING POLICY: Global trends in disclosure as the ESG agenda goes mainstream(Carrots & Sticks)

- The economic realities of ESG (PWC)

- The numbers that are changing the world (KPMG)

- Global Survey Finds Businesses Increasing ESG Commitments, Spending (Navex)

- ESG Global Study 2022 (Harvard)

- 88% Of Consumers Want You To Help Them Make A Difference (Forbes)

- Four Facts About ESG Beliefs and Investor Portfolios (NBER)

- Globally Consistent ESG Reporting (Deloitte)

- ESG investing - statistics & facts (Statista)

- PwC: ‘Only 29% of investors say current company reporting adequately describes ESG’s impact on business performance’ (PWC)

.avif)